washington estate tax return due date

Generally the District of Columbia estate tax return must be filed and the tax paid within 10 months after the death of the decedent. 4 rows a The Washington estate tax return state return must be filed with the Washington.

New 2017 Federal Tax Deadlines Corporate Tax United States

Certain estates are required to report to the IRS and the recipient the estate tax value of each asset included in the gross estate within 30 days of the due date including extensions of.

. 1 Essential Government Services. Page 2 ADDENDUM 1 - QUALIFIED TERMINABLE INTEREST PROPERTY QTIPWA 2044 AND QUALIFIED DOMESTIC TRUST QDOT INSTRUCTIONS WHO MUST FILE This addendum must. 13 rows Due Date for Estate Income Tax Return.

The Washington estate tax is not portable for married couples. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Nonprofit property tax exemption applications are due March 31.

If a due date falls on a Saturday Sunday or legal holiday the due date changes to the next business day RCW 112070. A The Washington estate tax return state return must be filed with the Washington state. Utility company annual returns are due March 15.

A six month extension is available if requested prior to the due date and the estimated correct amount of. However a 6-month extension of time to file may be. The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due nine months.

1 A Washington return must be filed if the gross estate equals or exceeds the applicable exclusion. 15 RCW 8412230 and 260. Report income distributions to beneficiaries and to the IRS on.

The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due. 5 October On or before Oct. If a Washington state estate tax return is required your executor will have to either file it nine months after the.

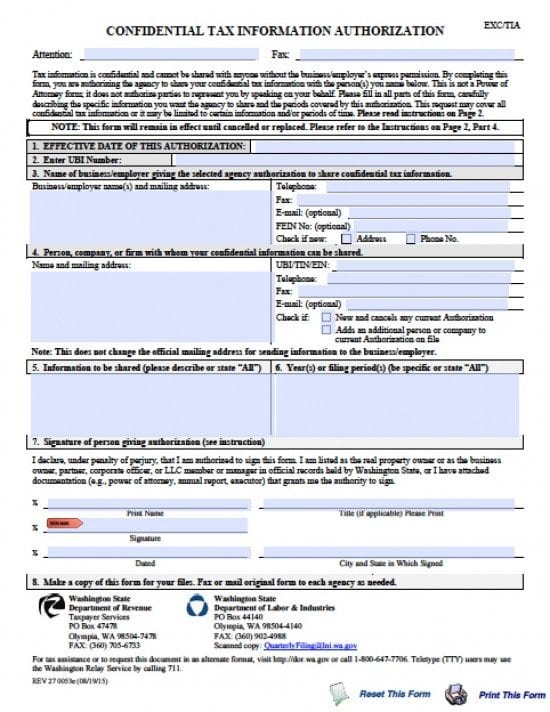

The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due nine months. Tax returns Filing dates Extensions Extensions during state of emergency. The return is filed with the Department of Revenue Audit Division PO Box 47474 Olympia WA 98504-7474.

However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries. The return is due nine months after the date of death of the decedent. 31 rows Generally the estate tax return is due nine months after the date of death.

What To Know About Covid 19 And Taxes Deadline Delays The Cares Act And More

Important Tax Change For Businesses Filing Annually Nfib

Excise Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Washington Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tax Due Dates For 2023 Including Estimated Taxes

Irs Will Delay Tax Filing Due Date Until May 17

Irs Again Faces Backlog Bringing Refund Delays For Paper Filers

Account Id And Letter Id Locations Washington Department Of Revenue

Where To Mail Tax Return Irs Mailing Addresses For Each State

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Washington Estate Tax Everything You Need To Know Smartasset

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Ready To File Virginia Tax Return What The Final Tax Law Looks Like Is Anyone S Guess