does cash app report crypto to irs

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. Contact a tax expert or visit the.

Does Cash App Report To The Irs

Include your totals from 8949 on Form Schedule D.

. Ahead of the April 18 tax deadline consumers will still need to report their crypto holding despite the 2023 bill. For those still needing to file the IRS issued a revised tax form. As a merchant or individual you need to know the IRS rules for reporting cash app income.

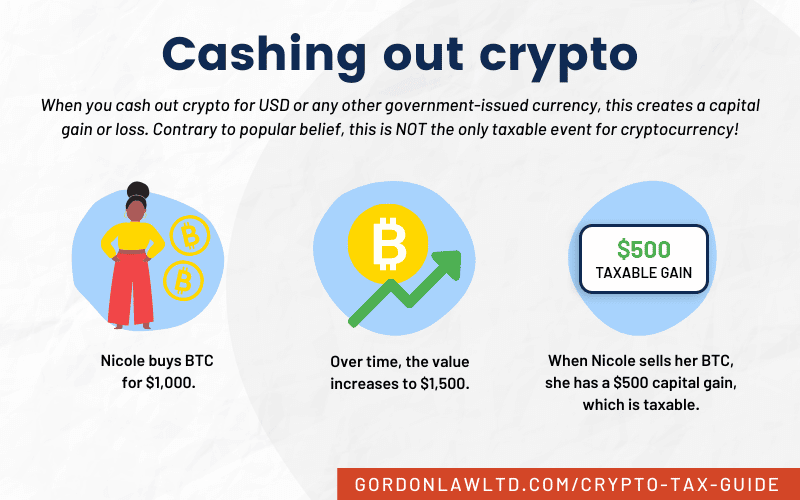

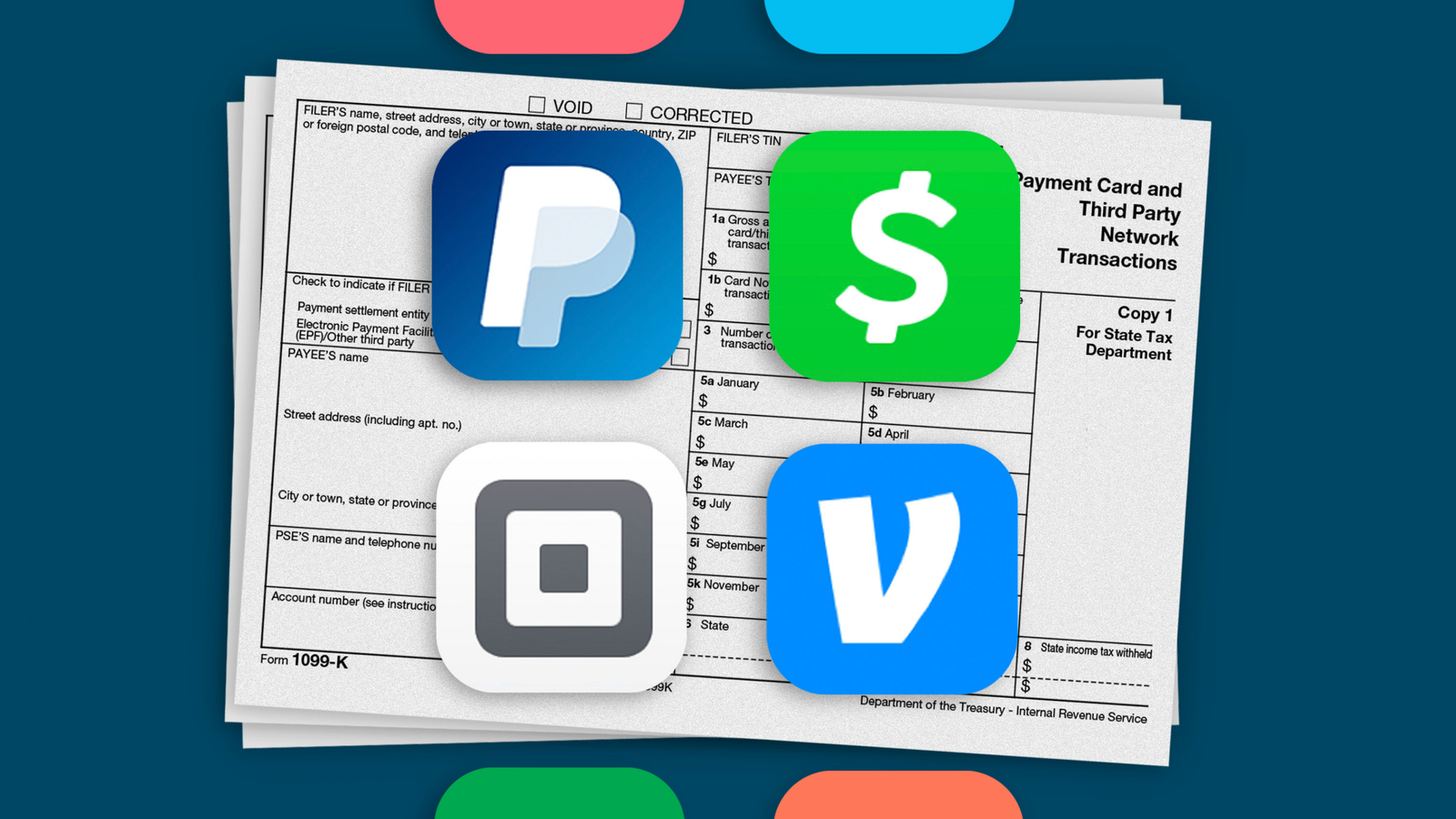

If you receive a Form 1099-K or Form 1099-B from a crypto exchange without any doubt the IRS knows that you have reportable crypto currency. Why did I receive a 1099-K from PayPal. Another calls for crypto asset exchanges and.

On an annual basis the IRS estimates they are going to collect. The date of each transaction. However in Jan.

One proposal would require businesses to report to the IRS all cryptocurrency transactions valued at more than 10000. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. The IRS has been very proactive and very blunt in their focus around cracking down on crypto tax avoidance.

1099-K 1099-B. Do I qualify for a Form 1099-B. 2022 the rule changed.

Remember there is no legal way to evade cryptocurrency taxes. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS. Personal Cash App accounts are exempt from the new 600 reporting rule.

If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. Will Venmo send me a 1099. Coinbase has received a lot of criticism for issuing the 1099-K.

So much that in 2020 Coinbase announced that it would no longer be issuing 1099-K s for trading. Calculate your crypto gains and losses. Does Binance report to IRS.

Any 1099-B form that is sent to a Cash App user is also sent to the IRS. In the past few years many small businesses have embraced the use of digital. Your cost basis or the fair market value of your crypto in USD the day you.

There are 5 steps you should follow to file your cryptocurrency taxes. How much taxes do you pay on crypto. Does Cash App report to the IRS.

Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually. Cash App does not provide tax advice. If you have sold Bitcoin.

The IRS want a lot of information about your crypto assets including. The mobile app also gives users crypto credits. Complete IRS Form 8949.

Does Cash App Report To The Irs

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

Infrastructure Bill Cracks Down On Crypto Tax Reporting What To Know

Crypto Taxes Made Simple With Cointracker In 2022 Tax Software Tax Guide Bitcoin

Does Cash App Report To The Irs

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Crypto Tax Guide 2022 How To Report Crypto On Your Taxes

How Is Cryptocurrency Taxed Here S What You Need To Know Kiplinger

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

Does Cash App Report To The Irs

Does Cash App Report To The Irs

Premium Photo Gold Coin Bitcoin Currency Blockchain Technology Finance Investisseur Cryptomonnaie

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Cryptocurrency Taxes What To Know For 2021 Money

The Irs Is Cracking Down On Digital Payments Here S What It Means For You Cnn Business

Cash App Bitcoin Tax Reporting Cryptotrader Tax Youtube

Please Report The Bitcoin Com Wallet To The Ios App Store For Fraud Bitcoin Bitcoin Wallet Bitcoin Transaction