what is a quarterly tax provision

Choosing a Financial Institution. This message means you have input an incorrect password to login to the site.

425 02 Chartered Accountant Mumbai Chartered Accountant Job Hunting Job Posting

The IRS continues to implement the Tax Cuts and Jobs Act TCJAThis major tax legislation affects individuals businesses and tax exempt government entities.

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

. DES Central Office Location. Implementation of Tax Collected at Source TCS on Sales consideration of Goods. Therefore although you may pay taxes annually or quarterly you should do an adjusting entry during each period for which you produce an income statement.

Employers Quarterly Federal Tax Return Form W-2. Vulnerabilities affecting Oracle Solaris may affect Oracle ZFSSA so Oracle customers should refer to the Oracle and Sun Systems Product Suite Critical Patch Update Knowledge Document My Oracle Support Note 21609041 for information on minimum revisions of security patches required to resolve ZFSSA issues published in Critical Patch Updates and Solaris Third. Employers Quarterly Federal Tax Return As mentioned earlier Part One is where the employer reports the amount of taxes paid on wages tips and other compensation.

An operating carrier with. For example you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. The Help Desk will reset the password for you.

The term foreign tax authority as used herein shall refer to the tax authority or tax administration of the requesting State under the tax treaty or convention to which the Philippines is a signatory or a party of. Corporate tax teams face the following common tax provision calculation issues. Installment Agreement Request.

Accounting Entries to be passed in the books of collector. But the study found that was not true. Yes but includible in income and subject to a 10 additional tax if under age 59-12.

700 Wade Avenue Raleigh NC 27605 Please note that this is a secure facility. G Authority to Accredit and Register Tax Agents. Those tax planning strategies may need to be considered when preparing the 2020 quarterly tax provisions.

Office of Inspector General OIG Treasury Inspector General for Tax Administration TIGTA. Employers engaged in a trade or business who pay compensation Form 9465. CBS Sports has the latest NBA Basketball news live scores player stats standings fantasy games and projections.

Establish a SIMPLE IRA Plan. Before sharing sensitive information make sure youre on a federal government site. Customers needing assistance with their unemployment insurance claim should contact us via phone at 888-737-0259.

Labour says it would freeze the cap at its current level meeting the 29 billion cost in part by imposing extra tax on oil and gas giants who it says are making eye-watering profits. Under these provisions certain employers called applicable large employers or ALEs must either offer health coverage that is affordable and that provides minimum value to their full-time employees and offer coverage to the full-time. Generally your tax home is the entire city or general area where your main place of business or work is located regardless of where you maintain your family home.

Alcohol and Tobacco Tax and Trade Bureau TTB Bureau of Engraving Printing BEP Financial Crimes Enforcement Network FinCEN Bureau of the Fiscal Service BFS Internal Revenue Service IRS Office of the Comptroller of the Currency OCC US. Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. Passports travel and living abroad.

Getting your calculation right requires starting with the right number for your net income. This list is not exhaustive. The employer shared responsibility provisions were added under section 4980H of the Internal Revenue Code by the Affordable Care Act.

The evidence shows that private philanthropy cant compensate for the loss of government provision Dr. Since the provision is new hence entities must make certain changes in their accounting. The International Fuel Tax Agreement or IFTA is an agreement between the lower 48 states of the United States and the Canadian provinces to simplify the reporting of fuel use by motor carriers that operate in more than one jurisdiction.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding quarterly estimated tax payments or a combination of the two. The situation is fluid and government responses around the globe are continuously changing. A new section 2061H has been introduced by government for collecting TCS on sale of goods with effect from 01 October 2020.

Back to the Top. Starting a SIMPLE IRA plan is easy to do. The Coronavirus State and Local Fiscal Recovery Funds SLFRF program a part of the American Rescue Plan delivers 350 billion to state local and Tribal governments across the country to support their response to and recovery from the COVID-19 public health emergency.

Also if withdrawals are made within the first two years of participation the 10 additional tax is increased to 25. Before making an Income quarterly estimated payment calculate online with the Quarterly Estimated Tax Calculator. Government activity Government activity.

RECIPIENT COMPLIANCE AND REPORTING GUIDANCE On June 17 2022 Treasury released the updated. Its fast easy and secure. - The Commissioner shall accredit and register based on their.

2018 the individual shared responsibility provision calls for each individual to either have minimum essential coverage for each month qualify for an exemption or make a payment when. Taxes Reported on Form 941. Donations do not match government assistance and without tax money social services are not funded as robustly.

Provision for Income Tax. If you are locked out of the system you will need to either call OSP at 2253428010 or email the Vendor Help Desk at vendr_inqlagov and provide your companys Federal Tax ID number for verification purposes. Under this new change individual taxpayers can claim an above-the-line deduction of up to 300 for cash donations made to charity during 2020.

Federal government websites often end in gov or mil. The gov means its official. Alaska Hawaii and the Canadian territories are not required to participate however all of Canada and Alaska do.

The entry to income tax expense will be a debit because you are increasing the expense account. In addition extension return and bill payments can also be made. Most companies report income annually or quarterly so the tax provision amount can only be estimated.

To help give tax professionals a better understanding of how the IRS is implementing the law we are providing internal training materials categorized by audiences - small businesses large businesses and. Working jobs and pensions. The items covered in this article are potential impacts that the COVID-19 crisis might have on your income tax provision.

This means the deduction lowers both adjusted gross income and taxable income translating into tax savings for those making donations to qualifying tax-exempt organizations.

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Gst Composition Scheme Key Features Eligibility And Registration Process

Strategies For Minimizing Estimated Tax Payments

The Standard Magazine Helping People Human Rights Campaign Learning

Launch Of Wikis Blogs Functionality In Itba Portal Http Taxguru In Income Tax Launch Of Wikis Blogs Functionality In It Income Tax Income Online Training

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

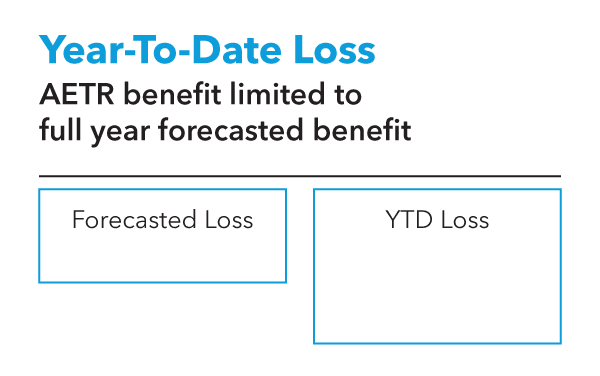

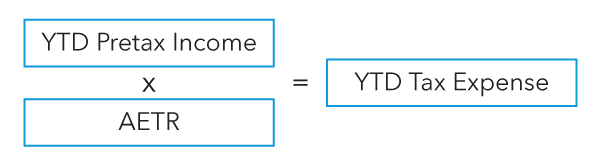

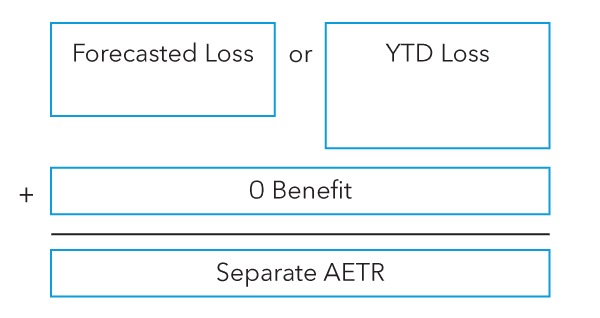

Asc 740 Interim Reporting Bloomberg Tax

How To Record Paid Estimated Tax Payment

Asc 740 Interim Reporting Bloomberg Tax

Provision For Income Tax Definition Formula Calculation Examples

Asc 740 Interim Reporting Bloomberg Tax

How To Record Paid Estimated Tax Payment

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Asc 740 Interim Reporting Bloomberg Tax

Accounting Tax Preparation Payroll Accounting Services Payroll Income Tax